Grow Your Personal Wealth Experience

Find the tools you need to commence your financial journey at your own pace, all in one spot.

Spark Empowers All Australians to Take Control of Their Finances

Our comprehensive suite of professional investment services, aimed at those starting out, provides detailed educational material from industry-leading experts and sources, plus a close-up view of your cash flow via a dedicated online portal accessible via web and mobile.

Then, when you are ready to commence your investment journey, you’ll have access to wealth management advice and professional investment portfolio management that won’t cost you anything to set up. With everything you need at your fingertips, it’s as simple as 1, 2, 3 to expand your financial literacy, manage your money and begin investing.

How You Can Get Started

Step 02

Step 03

Step 1:

Ever wondered ‘What are managed funds?’ or ‘What is a good investment’? Improve your financial literacy and explore new opportunities with high-value insights into the world of finance. Wealth investment advice will be delivered directly to your inbox, along with access to past releases by topic, so you can catch up on anything you’ve missed.

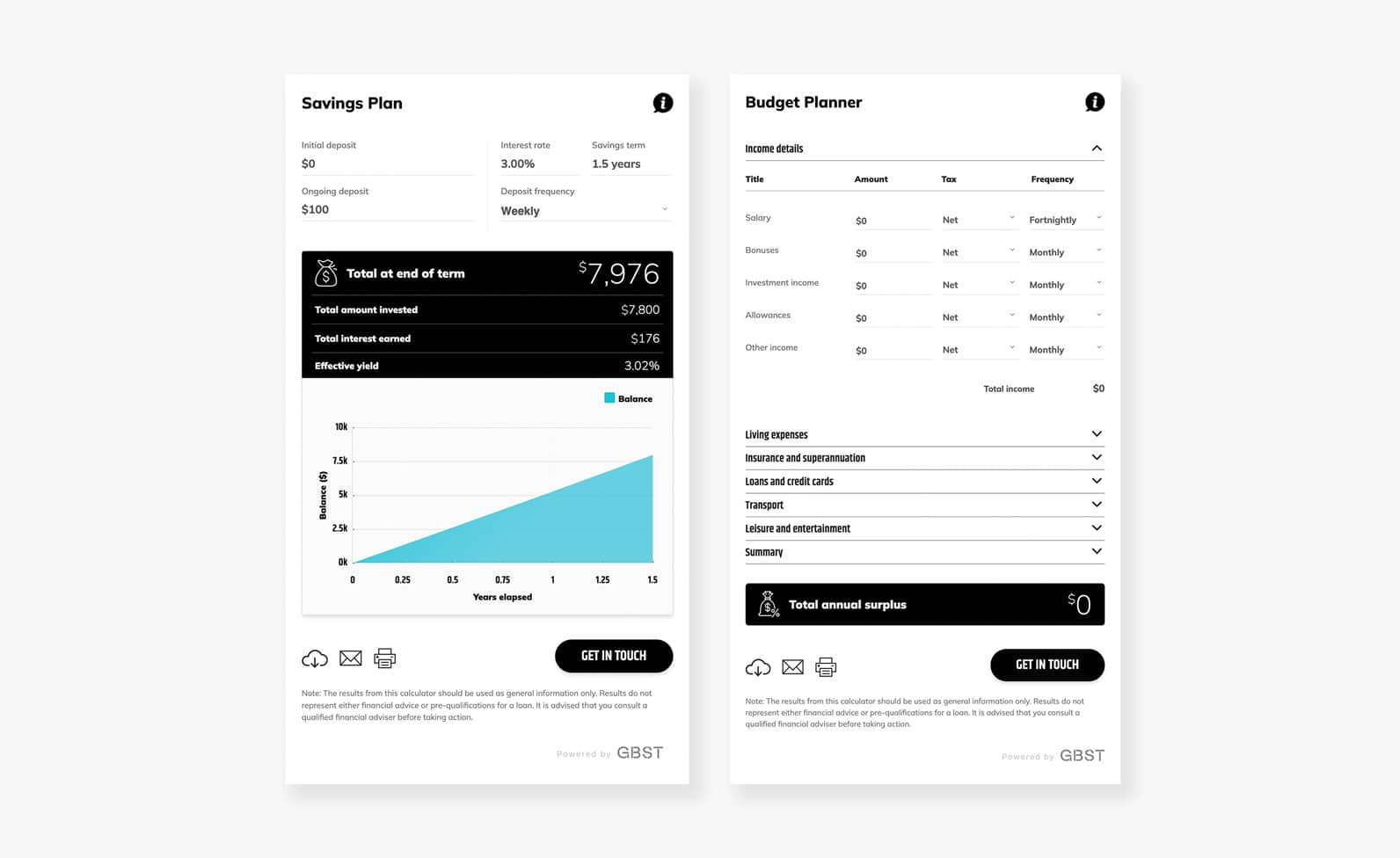

Use Our Calculators

Asking yourself ‘How do I budget to save the $5,000 I need to commence an investment portfolio’? Or wondering how much you could save by comparing home loan offers? What about how much do you need to retire? Get answers to these questions by using our comprehensive suite of calculators — which will also provide you with print and downloadable outputs for your records.

Use Our Calculators

Asking yourself ‘How do I budget to save the $5,000 I need to commence an investment portfolio’? Or wondering how much you could save by comparing home loan offers? What about how much do you need to retire? Get answers to these questions by using our comprehensive suite of calculators — which will also provide you with print and downloadable outputs for your records.

Step 2:

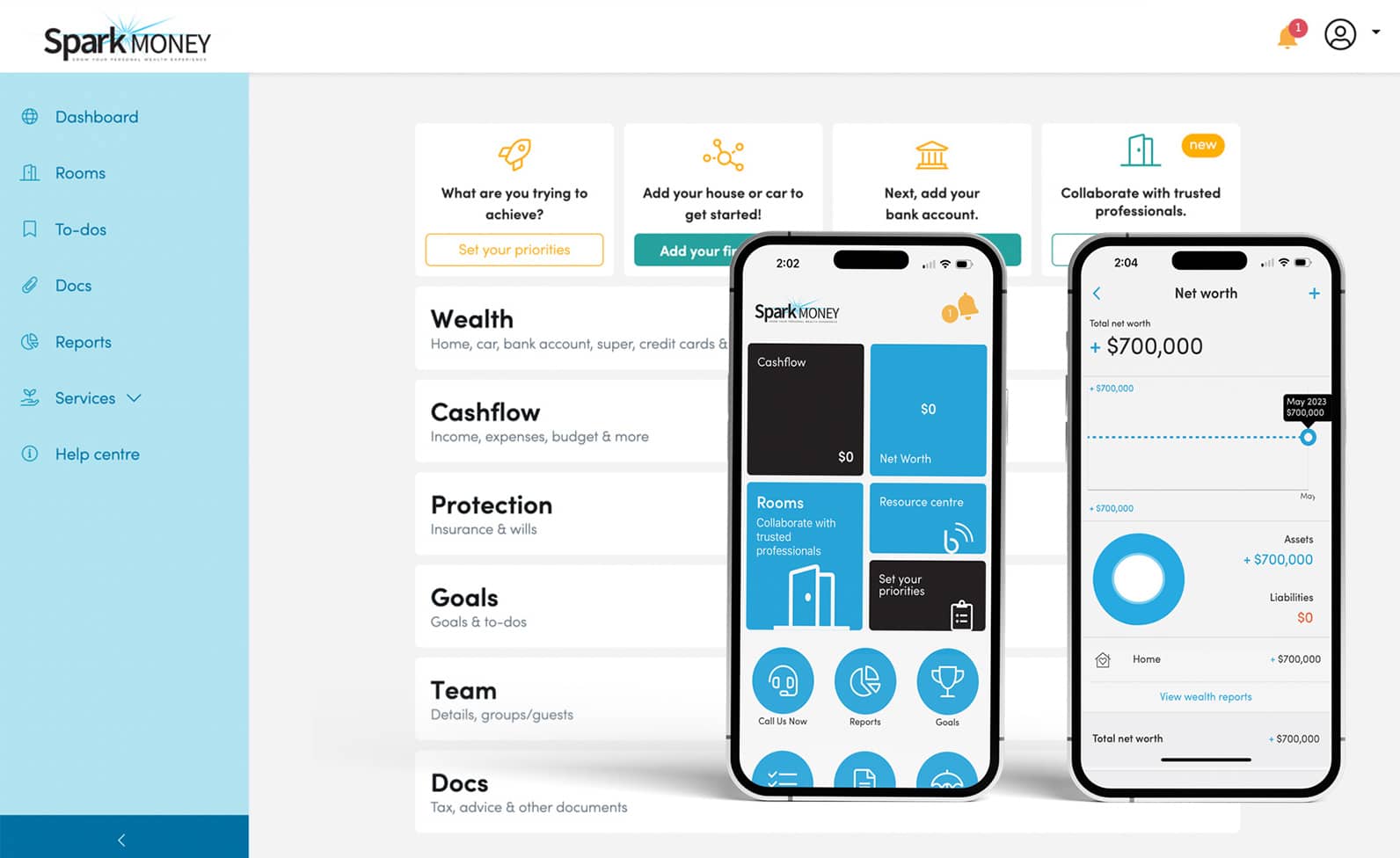

Build your financial future on a strong foundation by using our dedicated app to manage your budget and cash flow. With Spark Money, you receive data feeds from all your bank accounts to see exactly where your money is going. You can then set a budget to help manage your spending to build towards your savings goals.

Spark Money can also link further assets and value them such as your home, motor vehicle and shares.

Download the App

Get started with Spark Money today

Download the App

Get started with Spark Money today

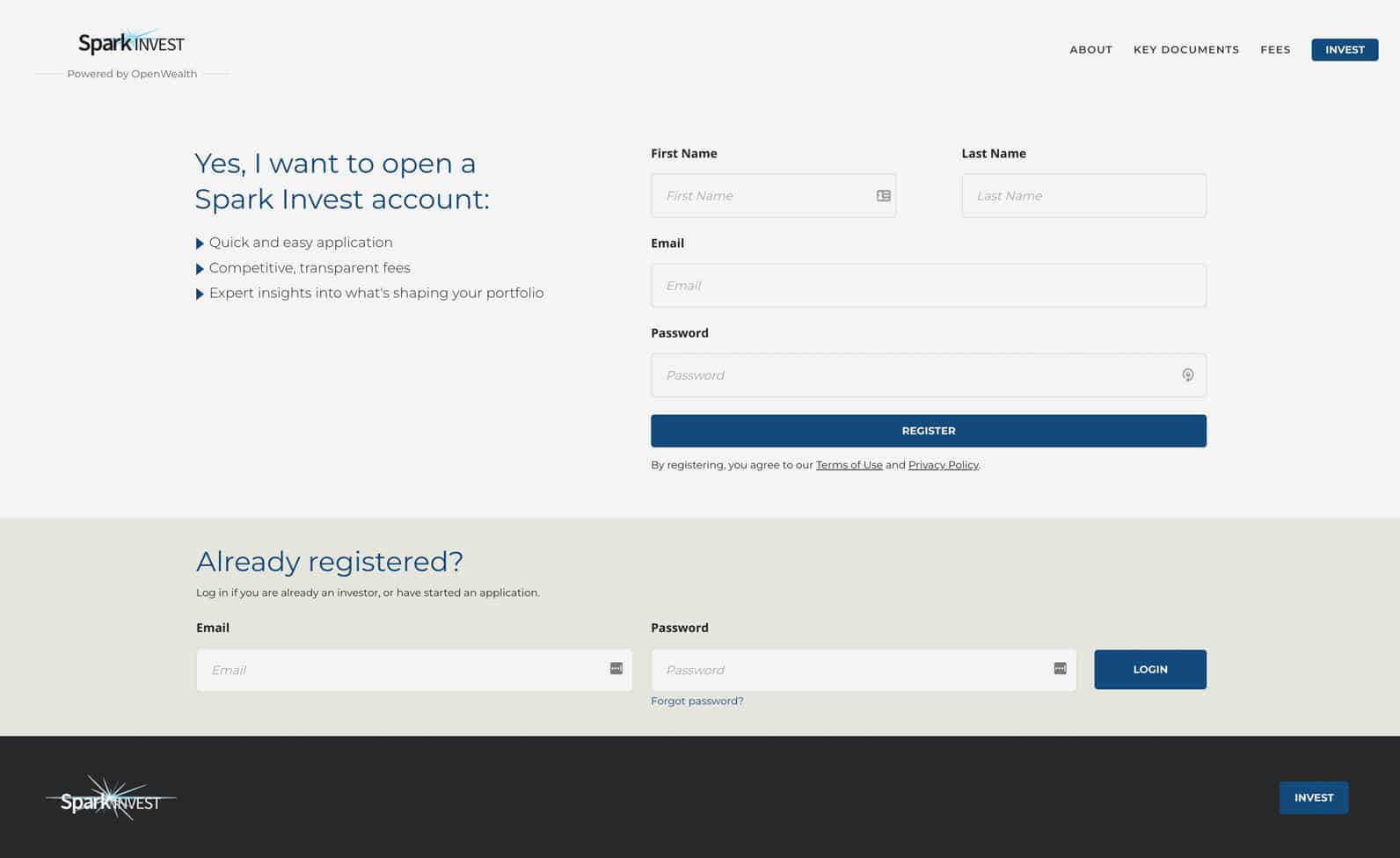

Step 3:

Next, when it’s time to start investing, do so with the team at Spark Invest. Our personal wealth management experts can help you reach those larger goals more quickly, through our five professionally managed investment portfolios. Thanks to decades of experience, our advisors have the personal finance solutions you need to get onto the fast track. Spark Invest also provides you with investment insights from our Chief Investment Officer, and the opportunity to get up close and personal with the investment managers via tailored content and education.

How Do I Invest Money?

When you’re first embarking on a personal wealth journey, it’s natural to have a lot of questions. ‘How do I invest in shares?’, ‘How do I invest in managed funds?’, or even the fundamental ‘How do I save money?’ Take the mystery out of wealth management and empower yourself with financial education from Spark. Our experienced team has the resources you need to guide your own learning. Stop asking yourself the basic questions like ‘How do I invest money?’ and start asking yourself the more interesting ones like ‘Where do I invest?’. Still have questions? The experts at Spark Invest are ready to manage your portfolio.

For Personalised Advice, Reach Out to Our Financial Advisors Today!

Find An AdvisorSpark Corporate Authorised Representatives are authorised through Axies Pty Ltd ABN 38 136 704 446 (AFSL No. 339384) and Spark Advisors Australia Pty Ltd ABN 34 122 486 935 (AFSL No. 380552), who receive services from Spark Financial Group ABN 15 621 553 786 & Spark Lending credit representatives are authorised through Outsource Financial Pty Ltd ABN 42 131 090 705 (ACL No.384324) are not, profit for purpose entities.

General Advice Warning: The information and advice contained on this webpage and website has been prepared for general information purposes only and does not take into account your personal objectives, financial situation or needs. It is not intended to provide commercial, financial, investment, accounting, tax or legal advice. You should, before you make any decision regarding any information, strategies, or products mentioned on this website, consult a professional financial advisor to consider whether it is suitable and appropriate for you and your personal needs and circumstances. Product Disclosure Statements and Information Memoranda contain information necessary for you to make a decision whether or not to invest in financial products mentioned on this website. You should also obtain and read this document prior to proceeding with any decision to purchase a financial product. Although every effort has been made to verify the accuracy of the information contained in this document, Spark Financial Group, its officers, representatives, employees and agents disclaim all liability (except for any liability which by law cannot be excluded), for any error, inaccuracy in, or omission from the information contained in this document or any loss or damage suffered by any person directly or indirectly through relying on this information.